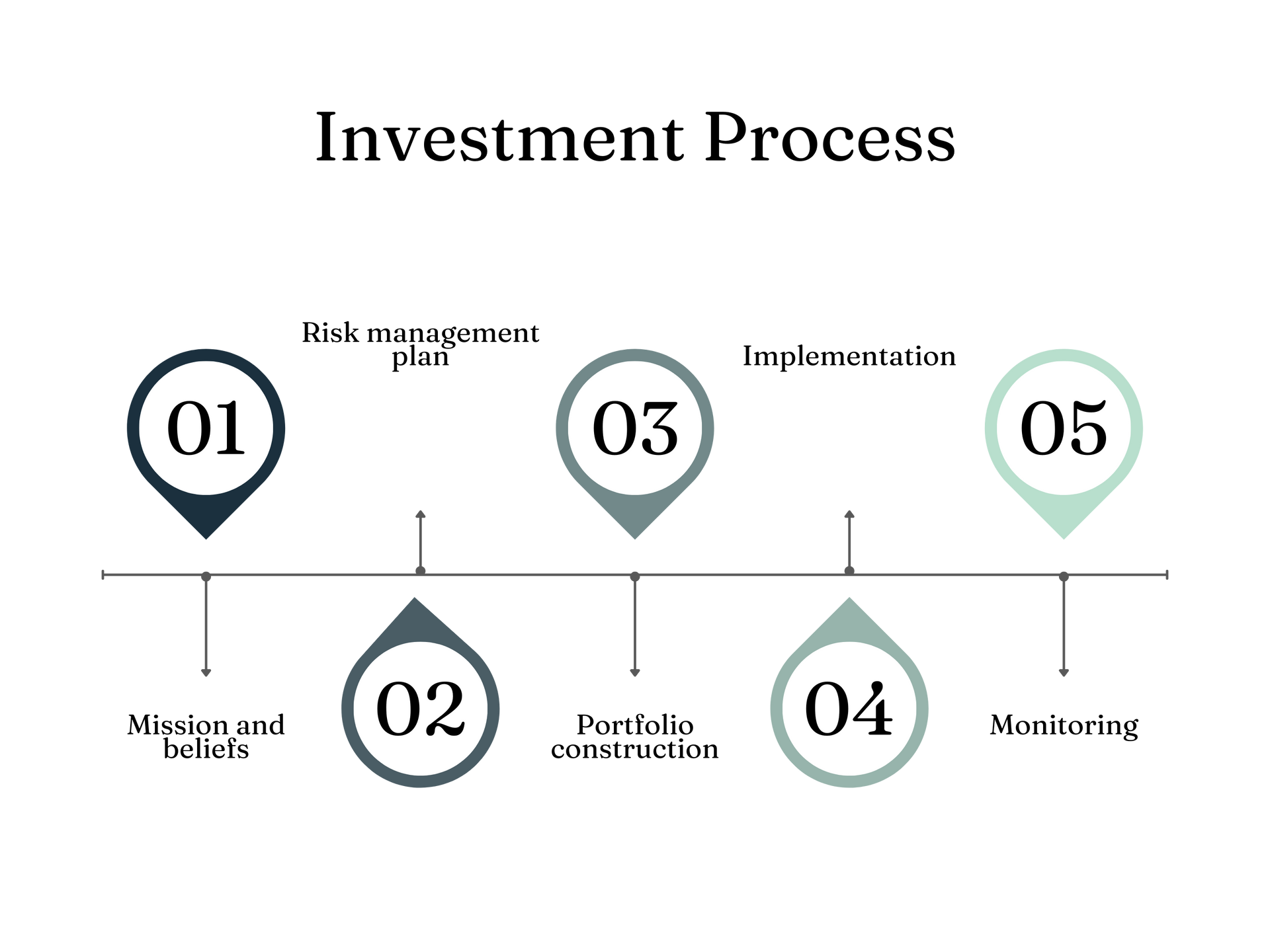

FAN'S INVESTMENT PROCESS

Our mission is to help you organize and manage your financial life, while continuously monitoring your progress as we work towards you achieving your financial goals. Regardless of your position or aspirations there are a few principles that are non-negotiable and are the primary drivers of you achieving your financial goals.

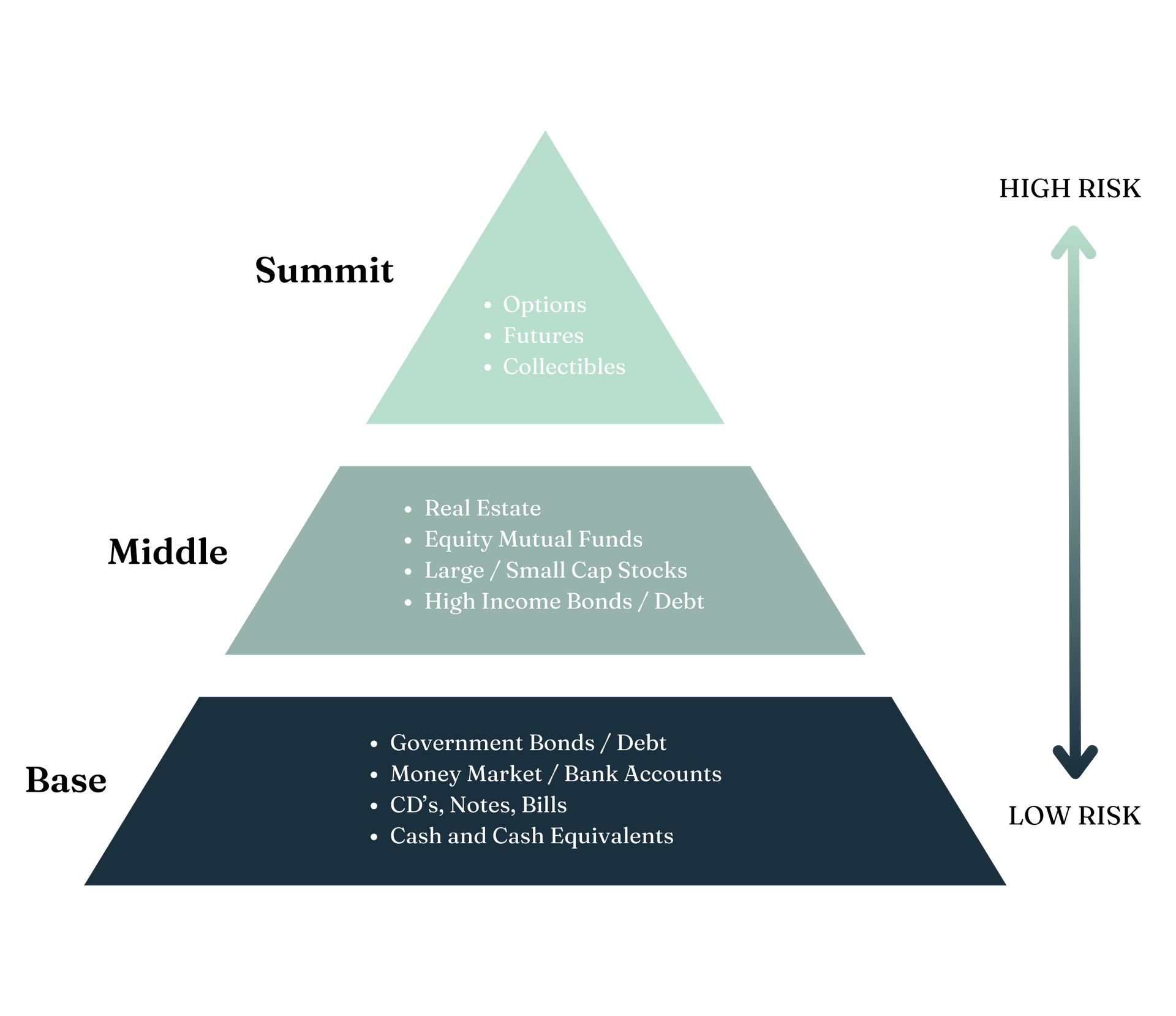

ASSET ALLOCATION

FAN’s professionals consider asset allocation a crucial investment decision, as it determines investment outcomes more so than selecting individual securities. Asset allocation diversifies an investment portfolio among various asset classes to attain desired risk and return goals, significantly influencing portfolio performance.

Here are some reasons why asset allocation is important:

- Diversification: By investing in a mix of asset classes, investors can spread their risk, reduce market impact, and potentially enahnace long-term returns.

- Risk Management: Aligns your investments with your goals, time horizon, and risk tolerance. This diversification can minimize the risk of a single asset class on your portfolio.

- Return Maximization: Results from investing in a diversified mix of assets that have the potential to perform well in different market conditions.

- Rebalancing: Maintains alignment with your goals and risk tolerance potentially yielding better returns over time.

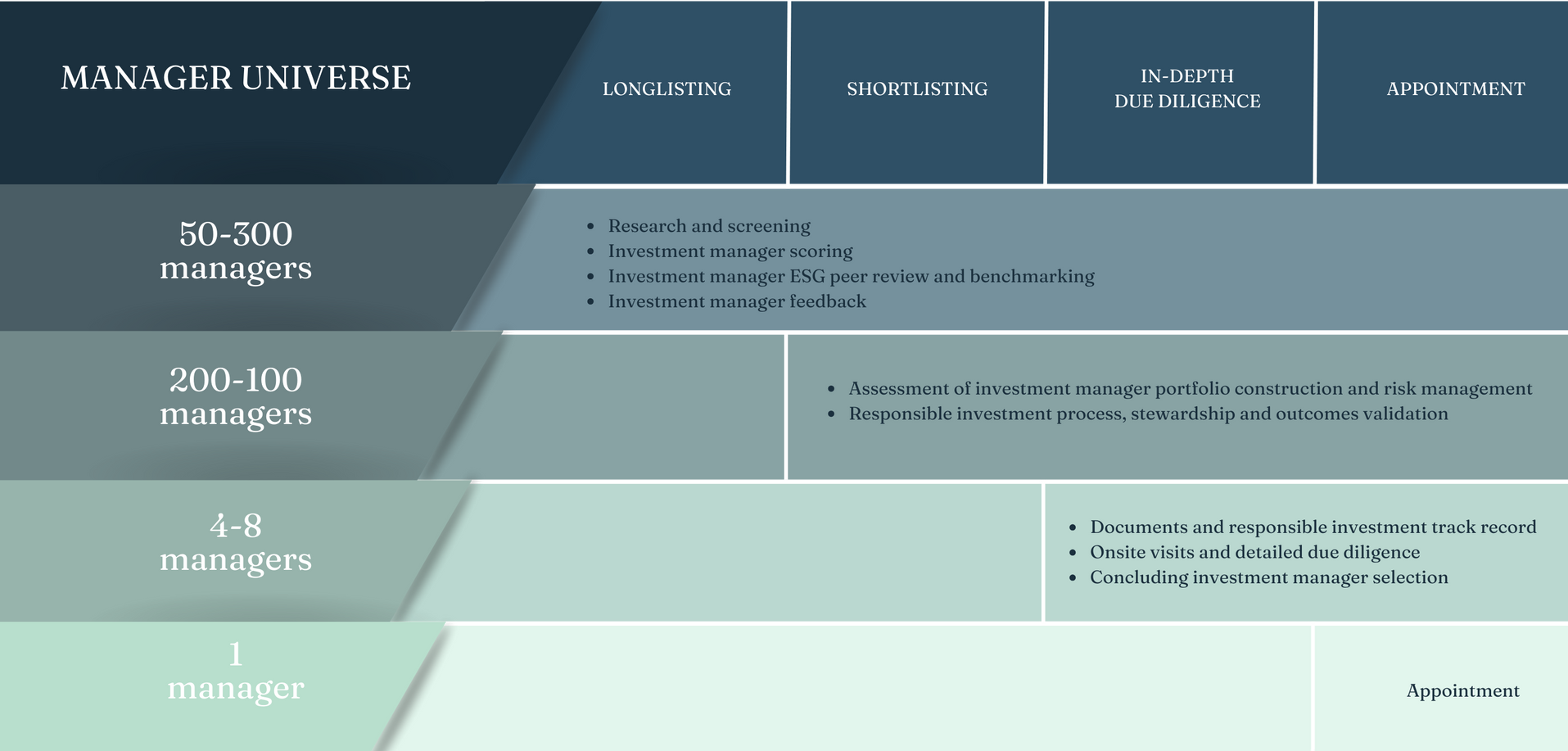

INVESTMENT MANAGER SELECTION PROCESS

FAN's investment manager selection process is thorough rigorous process encompassing the following steps:

- Defining investment objectives: We first define your investment objectives, including risk tolerance, time horizon, and desired return to identify potential investment managers specializing in relevant asset classes.

- Identifying potential investment managers: We identify potential investment managers through in-house research, discussions with chief investment officers (CIOs), online searches, and professional networking events.

- Conducting initial screening: Once identified, potential investment managers, are put through an initial screening to assess their qualifications, experience, investment strategy, performance track record, and fees. We conduct the initial screening using third-party databases, regulatory filings, and in some cases direct communication with the investment managers and/or their spokesperson.

- Conducting due diligence: Our detailed due diligence review of an investment manager involves assessing the manager's investment philosophy, investment process, risk management approach, and operational infrastructure through site visits, interviews with key personnel, and reviews of audited financial statements.

- Manager selection: We select your investment manager(s) that meet your investment objectives, risk profile, and budget based on quantitative and qualitative factors, including investment performance, risk management, and client service.

- Monitoring and evaluation: After selecting an investment manager, we continually monitor and evaluate their performance, including regular reporting and periodic reviews of strategy and results. If they fail to meet our expected standards, we may replace them in consultation with you.

RISK MANAGEMENT

Effective investment portfolio risk management is crucial in helping investors to preserve capital, avoid losses, and achieve their investment objectives.

Risk Management strategies should include:

- Diversification: One of the most effective ways to manage risk is to diversify across different asset classes which may reduce the impact of market as different assets perform differently under different market conditions.

- Asset allocation: Asset allocation involves dividing the portfolio among different asset classes based on the investor's risk tolerance, investment objectives, and time horizon.

- Risk measurement and analysis: Your FAN professional uses a variety of tools and metrics to measure and analyze risk in your portfolio. This helps us to identify potential risks and monitor their exposure to various types of risk.

- Risk mitigation strategies: We can implement various risk mitigation strategies to minimize potential losses in your portfolio. These may include hedging, buying insurance, or using stop-loss orders to limit losses on individual positions.

- Regular portfolio monitoring and review: Regular monitoring and review of portfolio performance, market trends, and adjusting the portfolio as needed to maintain the desired risk profile and investment objectives.

Risk Management in an investment portfolio is a dynamic process that requires ongoing attention and adjustment. Using a range of risk management strategies, investors can potentially minimize losses, maximize returns, and achieve long-term investment success aligned with their goals and risk tolerance.

Mutual Funds and Exchange-Traded Funds are sold only by prospectus. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the company or from your financial professional. The prospectus should be read carefully before investing or sending money.

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

Investing involves risk, including loss of principal.

Past performance is no guarantee of future results.

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Advisor Networks LLC nor any of its representatives may give legal or tax advice.

Asset allocation, which is driven by complex mathematical models, cannot eliminate the risk of fluctuating prices and uncertain returns.

Re-balancing may be a taxable event. Before you take any specific action be sure to consult with your tax professional.

Cetera Wealth Partners is a region of Cetera Advisor Networks. Securities and advisory services offered through Cetera Advisor Networks LLC., member FINRA/SIPC, a broker/dealer and a Registered Investment Adviser. Cetera is under separate ownership from any other named entity.

Individuals affiliated with this broker/dealer firm are either Registered Representatives who offer only brokerage services and receive transaction-based compensation (commissions), Investment Adviser Representatives who offer only investment advisory services and receive fees based on assets, or both Registered Representatives and Investment Adviser Representatives, who can offer both types of services.

This site is published for residents of the United States only. Registered representatives of Cetera Advisor Networks LLC may only conduct business with residents of the states and/or jurisdictions in which they are properly registered. Not all of the products and services referenced on this site may be available in every state and through every representative listed. For additional information, please contact the representative (s) listed on the site or visit the Cetera Advisor Networks site at www.ceteraadvisornetworks.com

Important Disclosures | Business Continuity | Order Routing Disclosure | www.ceteraadvisornetworks.com | Check the background of this investment professional on FINRA's BrokerCheck